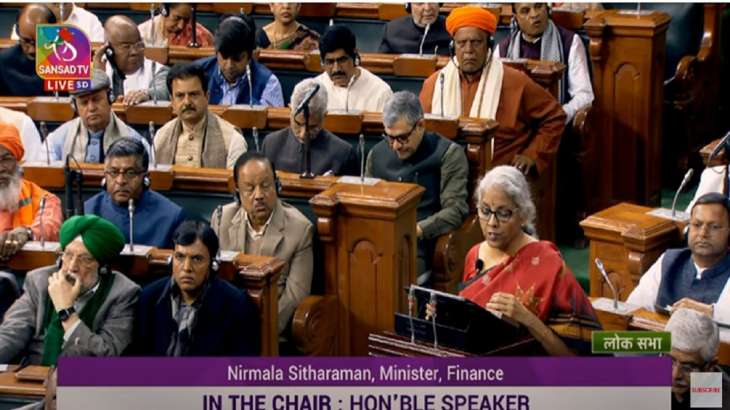

In a major help for the everyday person, the Modi government on Wednesday expanded the individual annual duty discount to Rs 7 lakh for each annum. The personal assessment discount is one of the 5 significant declarations made by Finance Minister Nirmala Sitharaman in the main spending plan of ‘Amrit Kaal’. Sitharaman changed the pieces to give a help to the working class by reporting that no duty would be imposed on yearly pay of up to Rs 7 lakh under the new expense system. She likewise permitted a Rs 50,000 standard derivation to citizens under the new system, where assessees can’t guarantee derivations or exceptions on their investments. The Union Minister additionally changed the concessional charge system, which was initially presented in 2020-21, by climbing the assessment exemption limit by Rs 50,000 to Rs 3 lakh and decreasing the quantity of sections to five. With impact from April 1, these slabs will be adjusted according to the Financial plan declaration.

Five major announcements by Nirmala Sitharaman on Income Tax in Budget 2023

1) New personal Income Tax slabs:

- 0 to Rs 3 lakhs – Nil

- Rs 3 to 6 lakhs – 5%

- Rs 6 to 9 Lakhs – 10%

- Rs 9 to 12 Lakhs – 15%

- Rs 12 to 15 Lakhs – 20%

- Above 15 Lakhs – 30%

2) An individual with an income of Rs 15 lakh will have to pay Rs 1.5 lakh tax down from Rs 1.87 lakh under the new tax structure.

3) The government has proposed to reduce the highest surcharge rate from 37 per cent to 25 per cent in the new tax regime.

4) Sitharaman told Parliament that the limit of Rs 3 lakh for tax exemption for such employees was last fixed in 2002 when the highest basic pay in the government was Rs 30,000 per month. “In line with the increase in government salaries, I am proposing to increase this limit to Rs 25 lakh.

5) The Modi government has made the new tax structure a default tax scheme.

Reacting to the Modi government’s budget, Congress MP Karti Chidambaram said, “I am a believer in a low tax regime. So, any tax cuts are welcome because giving more money into the hands of the people is the best way to boost the economy.”